An equity fund for charities looking to earn good long term returns whilst being concerned for the climate.

It takes a Christian ethical approach to investing.

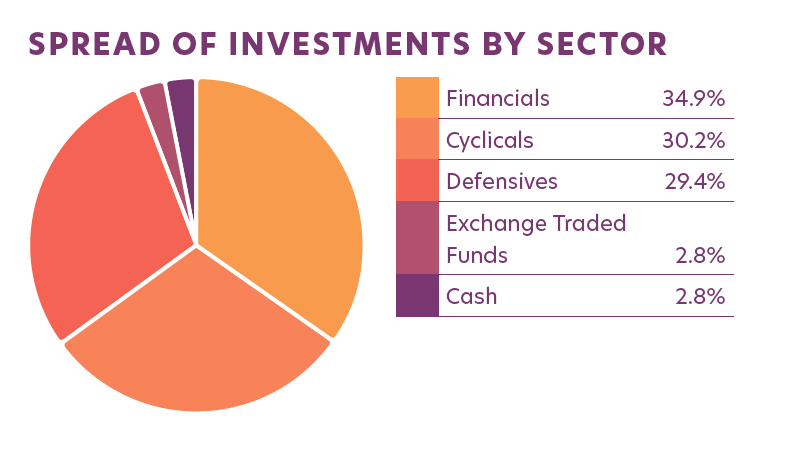

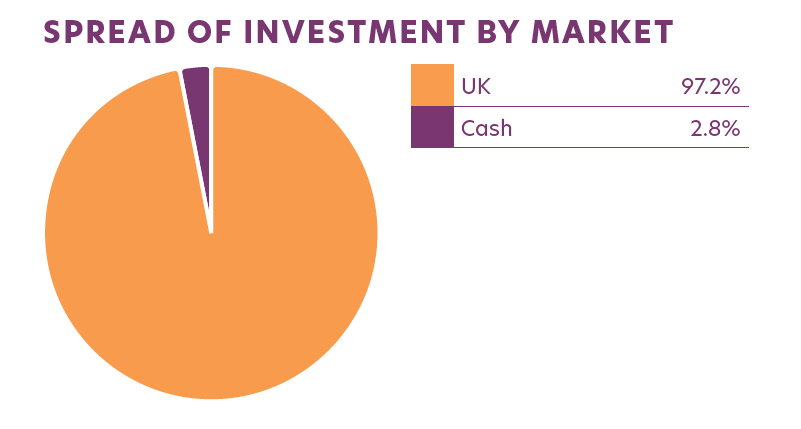

The Fund seeks income and capital investment growth over a minimum period of 5 years through investing mainly in UK companies, excluding those with significant exposure to greenhouse gas emissions.

The Fund will look to have a carbon footprint substantially below (at least 15%) that of the FTSE All Share Index by:

We aim to ensure that our portfolios are consistent with the Christian faith. As a result, the Fund will also avoid investment in companies whose business is wholly or mainly involved in alcohol, armaments, gambling, high interest lending, the oil and gas sector, pornography, tar sands, thermal coal and tobacco.

We are stewards of our investors’ capital and seek to use our influence to improve ethical standards by engaging with the management of the businesses we invest in on a wide range of issues, including climate change.

| To 31 March 2024 | 1 year % |

3 years % p.a. |

Since 28.05.20 % p.a. |

|

|---|---|---|---|---|

| Fund | 5.5 | 4.8 | 6.7 | |

| Benchmark † | 8.4 | 8.0 | 10.0 |

*Fund launched 28 May 2020. Performance data has been calculated using Income B Units, which were available at launch only. These Units have a 0.10% per annum lower management charge than the Income and Accumulation Units that are now the only options available for new investment. Fund performance is net of fees. Past performance is not a reliable indicator of future performance. †FTSE All Share Index.

| Unit value p |

Distribution p |

|

|---|---|---|

| 25 April 2024 (Income units) | 113.02 | - |

| 25 April 2024 (Income B units) | 112.74 | - |

| 25 April 2024 (Accumulation units) | 127.22 | - |

For more information from Epworth directly, please email enquiries@epworthim.com or fill in the form below:

Epworth Investment Management Limited (Epworth) is authorised and regulated by the Financial Conduct Authority FCA registered number 175451. Incorporated in England and Wales. Registered number 3052894. Registered office 9 Bonhill Street, London EC2A 4PE.

Epworth managed funds are designed for long term investors. The value of units in funds can fall as well as rise and past performance is not a guide to future returns. The level of income is also variable and investing in Epworth’s funds will not be suitable for you if you cannot accept the possibility of capital losses or reduced income. Any estimates of future capital or income returns or details of past performance are for information purposes and are not to be relied on as a guide to future performance.

Please note: all calls are recorded

for compliance purposes

Site by : More Than Just Design