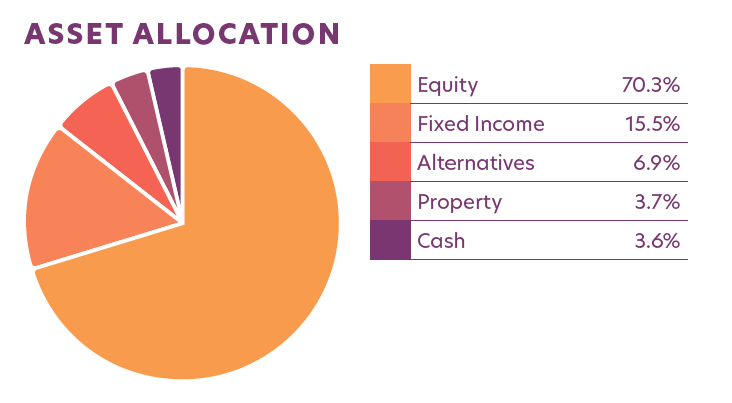

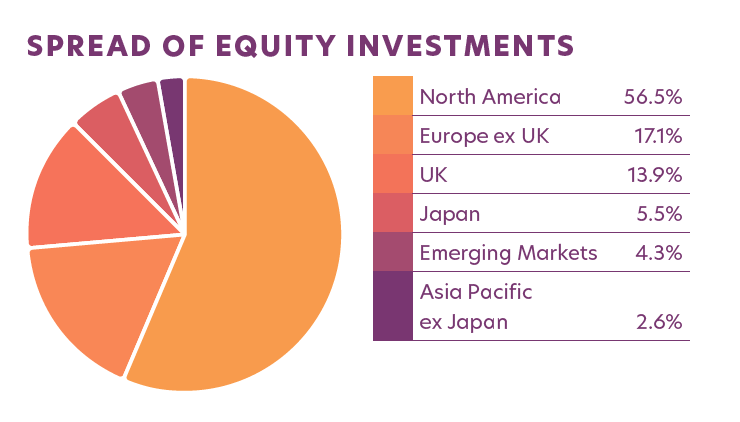

The Epworth Multi Asset Fund is an all-in-one investment fund solution for charities, seeking to deliver an attractive level of income and long-term capital growth. The Fund is designed for charities of all sizes and invests both directly and indirectly in a balanced portfolio of ethically screened equities, bonds, property, cash, and alternative assets. Our investment approach is designed to maximise the value we deliver to our clients, focusing on financial returns and the promotion of Christian ethics.

4 FE fundinfo Crowns An FE fundinfo Crown Fund Rating of four is awarded only to the top 15% of all funds. Recognising excellent achievement in three key measurement areas, a four FE fundinfo Crown fund is a significant accolade, representing a fund’s demonstrable ability to outperform over the medium to long term, whilst controlling risk effectively.

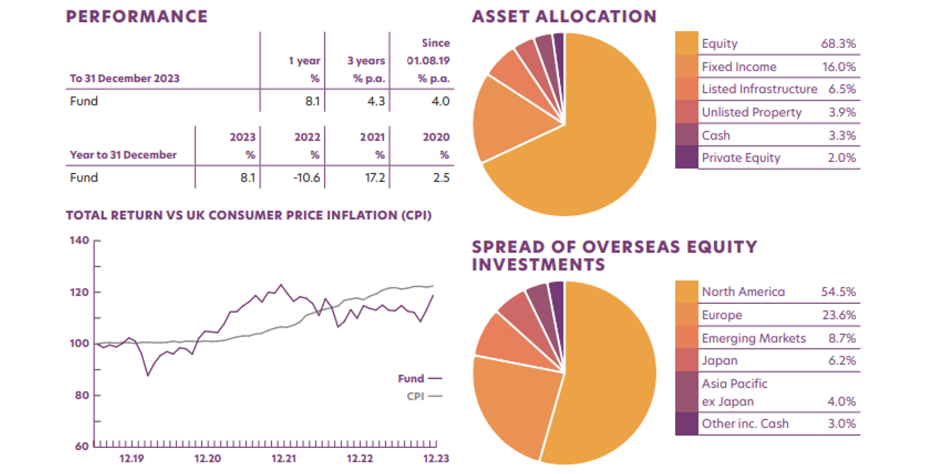

| Year to 31 December | 2023% | 2022% | 2021% | 2020% |

|---|---|---|---|---|

| Fund | 8.1 | -10.6 | 17.2 | 2.5 |

| 31 December 2023 | 1 Year% | 3 Years% P.A. | Since 01.08.19.% P.A. |

|---|---|---|---|

| Fund | 8.1 | 4.3 | 4.0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

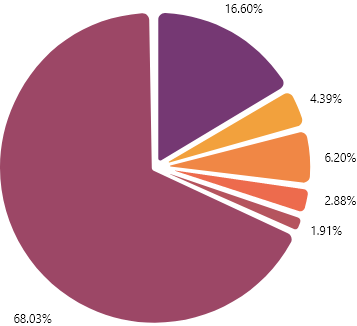

Epworth Global Equity for Charities |

Epworth UK Equity Fund for Charities |

Epworth Climate Stewardship Fund for Charities |

Rathbone Ethical Bond Fund |

Property Income Trust for Charities |

Vanguard UK Government Bond ETF |

iShares MSCI World ESG ETF |

Vanguard USD Treasury Bond UCITS ETF |

Columbia Threadneedle Opportunity Fund |

HG Capital Trust |

33.9 |

15.3 |

15.1 |

5.9 |

4.3 |

4.2 |

4.2 |

3.9 |

2.2 |

2.0 |

90.79

| To 31 March 2024 | 1 year % |

3 years % p.a. |

Since 01.08.19 % p.a. |

|

|---|---|---|---|---|

| Fund | 8.0 | 4.3 | 4.4 |

*Fund launched 11 June 2019. Actual performance based on Income Units launched after market close on 1 August 2019. Fund performance is net of fees. Past performance is not a reliable indicator of future performance.

| Unit value p |

Distribution p |

|

|---|---|---|

| 24 April 2024 (Income units) | 110.89 | - |

| 24 April 2024 (Accumulation units) | 121.74 | - |

The monthly interest distribution rate can fluctuate and past performance is no guarantee of future returns. To help manage the risk of capital losses, the Fund spreads its investments across a wide range of financial institutions. The possibility of capital loss does exist, however, it has never occurred in the Fund’s history.

A charge for same day transfers applies (currently £12 via CHAPS) or can be done for free in 2-3 days (via BACS). *We reserve the right to require 7 days’ notice of withdrawals in exceptional circumstances but typically provide same day access. Full details and terms, including the Scheme Particulars, can be found at www.epworthinvestment.co.uk. The Epworth Cash Plus Fund for Charities is exempt from the Financial Services and Markets Act 2000, and depositors are not eligible for the Statutory Investors Compensation Scheme or the services of Financial Services Ombudsman.

The Manager is however duly authorised under the Financial Services and Markets Act 2000. Epworth Investment Management Limited (Epworth) is authorised and regulated by the Financial ConductAuthority (Registered number 175451). Incorporated in England and Wales. Registered number 3052894. Registered office 9 Bonhill Street, London EC2A 4PE.

The Fund seeks exposure to companies and assets that typically demonstrate the following characteristics:

These entities exhibit a

transparent and robust

financial quality.

Leadership is

characterized by teams

that surpass industry

norms, showcasing sector leadership.

Emphasis is placed on

entities that provide

essential solutions

to significant societal

challenges.

All investments chosen by the Fund aim to promote the

Christian ideals set out in Epworth’s ethical pillars.

Guided by our Christian ethos, Epworth is dedicated to being good stewards of our investors’ money. Managed actively by an experienced investment team, the Multi Asset Fund offers exposure to Epworth’s extensive investment and ethical expertise as well as providing access to a diverserange of complementary third-party assets. This approach ensures a unique and comprehensive investment experience designed to align with both your charities’ financial goals and ethical considerations.

Click below to read our Case Studies

Hoya is a Japanese optics technology business focused on health applications, that is held as a conviction stock in the Epworth Global Equity Fund. A key part of the business is glasses and contact lenses, but the business also develops endoscopes, metallic orthopaedic implants, intraocular lenses, and other medical accessories.

A combination of ageing populations, a growing middle-class in developing economies and improved access to health care are driving significant demand for these products, in addition to the ongoing need for research and development to improve existing healthcare provision, as well as provide new solutions to improve wellbeing. There is also a growing focus on preventative medicine to cut health spending burdens caused by subsequent illnesses, which Hoya’s endoscopes help to address.

International Public Partnerships (INPP) is a listed infrastructure vehicle held directly by the Epworth Multi Asset Fund. It invests in a range of social and public infrastructure projects that offer attractive financial returns, but also significant societal and environmental benefits.

One of the projects INPP has invested in is the Thames Tideway Tunnel, a new investment in the London sewer network, which will carry sewage and storm water discharges from the existing sewerage network. London currently relies on a 150-year-old sewer system built for a population less than half its current size. The project will deliver improvements that will significantly reduce polluting discharges in a typical year by about 37 million cubic meters, resulting in a healthier river for London’s citizens and wildlife. INPP owns 16% of the project, which is constructing a 25km long, 7.2m diameter tunnel running up to 65 meters below the river Thames, replacing the Thames as a “sewer of last resort”. Construction is expected to complete in 2024.

INPP also finances the design, construction, and provision of facilities management services for several multi-use primary care health centers. These are mostly situated in the UK, but also in Australia and Italy.

Fairer Finance

An example of Epworth’s shareholder activism is reflected in some of its holdings in the UK financial services sector. Epworth’s parent organization, the Central Finance Board of the Methodist Church, is a Living Wage Accredited Employer, and Epworth regular engages with businesses, both directly and through collaborations, to encourage them to seek independent verification that they pay their staff a fair wage.

Epworth has two conviction holdings in the UK financial sector, wealth manager Brooks Macdonald and investment platform provider IntegraFin. Epworth selected these business because although they are far from the biggest operators in their respective markets, their efficient operating models and targeted approach results in industry leading profit margins, good customer service and strong organic growth. Both benefit from structural growth trends and trade on reasonable valuations whilst offering compelling returns on capital, which are the key criteria Epworth’s investment team seek in an investment.

Epworth has met regularly with the management of both companies since its shareholdings were established, pushing for both to improve their approach and disclosure around social responsibility and sustainability. One of the areas of success from these engagements is that Epworth has successfully persuaded both businesses to become Living Wage accredited employers.

Whilst pay in the finance sector is traditionally above the national average, this accreditation requires that contracted catering, cleaning and security staff are included. Epworth feel that the need for fair pay has taken on even greater significance in the cost of living crisis, and well run businesses can help tackle this issue at minimal additional cost to their own shareholders. It is fantastic that both businesses have responded positively to these engagements, and Epworth will continue to push for further positive changes from these and its other investments.

Ten Entertainment – “Up Epworth’s alley”

Ten Entertainment Group is the second-largest ten-pin bowling company in the UK, operating over 50 centres under the Tenpin brand. It also offers further entertainment such as laser arenas, a range of escape rooms, karaoke, arcades and tables sports, as well as offering food and drink.

Ten Entertainment was added as a conviction stock in 2017 due to its attractive growth characteristics and opportunity to leverage digitalisation. This allowed Ten Entertainment to better reach target customers, improve customer experience and generate an online presence. There was also a strong belief that, due to the fragmented nature of the bowling industry in the UK, Ten Entertainment could acquire run-down sites and upgrade them to generate exciting growth opportunities. Furthermore, the business is family-friendly, offering relatively cheap entertainment whilst generating employment for local younger people. As well as this, the valuation of the stock was considered cheap despite a strong management team track record of success and expertise.

Since 2017, the business has performed well and delivered strong growth, leading to a takeover bid for the business in December 2023. This saw Epworth exit its holding in the stock for a total return of around 160%.

Whilst a shareholder, Epworth enjoyed a positive engagement relationship with Ten Entertainment, regularly meeting with senior management to discuss important ethical issues. These included food waste, recycling, employee relations and carbon emissions, with considerable progress made by the company as a result of these engagements. Notably, Ten Entertainment has changed its energy supplier to ensure 100% renewable energy used across its sites, and the company has also massively improved its rates of recycling waste from its centres. The company is also targeting net zero carbon emissions for its operations and suppliers by 2030, which will involve installing solar arrays across its sites.

© 2024 FE fundinfo. All Rights Reserved. The information, data, analyses, and opinions contained herein (1) include the proprietary information of FE fundinfo, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by FE fundinfo, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete, or accurate. FE fundinfo shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, this information, data, analyses, or opinions or their use. FE fundinfo does not guarantee that a fund will perform in line with its FE fundinfo Crown Fund Rating as it is a reflection of past performance only. Likewise, the FE fundinfo Crown Fund Rating should not be seen as any sort of guarantee or assessment of the creditworthiness of a fund or of its underlying securities and should not be used as the sole basis for making any investment decision.

For more information from Epworth directly, please email enquiries@epworthim.com or fill in the form below:

Epworth Investment Management Limited (Epworth) is authorised and regulated by the Financial Conduct Authority FCA registered number 175451. Incorporated in England and Wales. Registered number 3052894. Registered office 9 Bonhill Street, London EC2A 4PE.

Epworth managed funds are designed for long term investors. The value of units in funds can fall as well as rise and past performance is not a guide to future returns. The level of income is also variable and investing in Epworth’s funds will not be suitable for you if you cannot accept the possibility of capital losses or reduced income. Any estimates of future capital or income returns or details of past performance are for information purposes and are not to be relied on as a guide to future performance.

Please note: all calls are recorded

for compliance purposes

Site by : More Than Just Design